Most Wineries View Glass as Most Sustainable Option, Shifting to Domestic Suppliers

by Andrew Adams

Aug 1, 2024

U.S. WINERIES APPEAR TO have little support for any new rules that would require them to add ingredient and nutrition information to their labels.

According to the annual WineBusiness Monthly packaging survey, 73% of all wineries surveyed do not support the mandatory listing of ingredients and allergens on packaging and 81% do not support a requirement to add nutrition data that could include calories per serving, sugar content, carbohydrates and other information.

Those who don’t support additional label requirements consider them an unnecessary cost and are worried it would make their labels less attractive while leaving less room for images and other marketing information.

Of the 19% that do support adding nutritional information to labels, 69% cited consumer demand for more product transparency, and that it would help wine stand out compared to other beverage alcohol products. Additional label requirements have already been imposed on U.S. wines destined for the EU market. Whether U.S. officials adopt similar regulations remains to be seen.

Cost Still a Primary Concern

Aside from concerns regarding additional label information requirements, cost remains the top concern, or driver, of packaging strategy for most wineries.

In 2023, 43% of all surveyed wineries reported controlling costs was their top concern and that rose to 47% this year. Ensuring adequate supply of packaging materials was the second most common driver of packaging strategy at 27% in 2023 but that share had shrunk to 11% this year.

Some of the most painful supply disruptions in recent years have centered on the availability and lead times for glass bottles, which remain the undisputed No. 1 choice for packaging wine. According to NIQ off-premise sales data, glass accounts for 87% of the nearly $20 billion in total wine sales and that share has only been eroded slightly by the wines packaged in alternatives such as aluminum cans or Tetra packs.

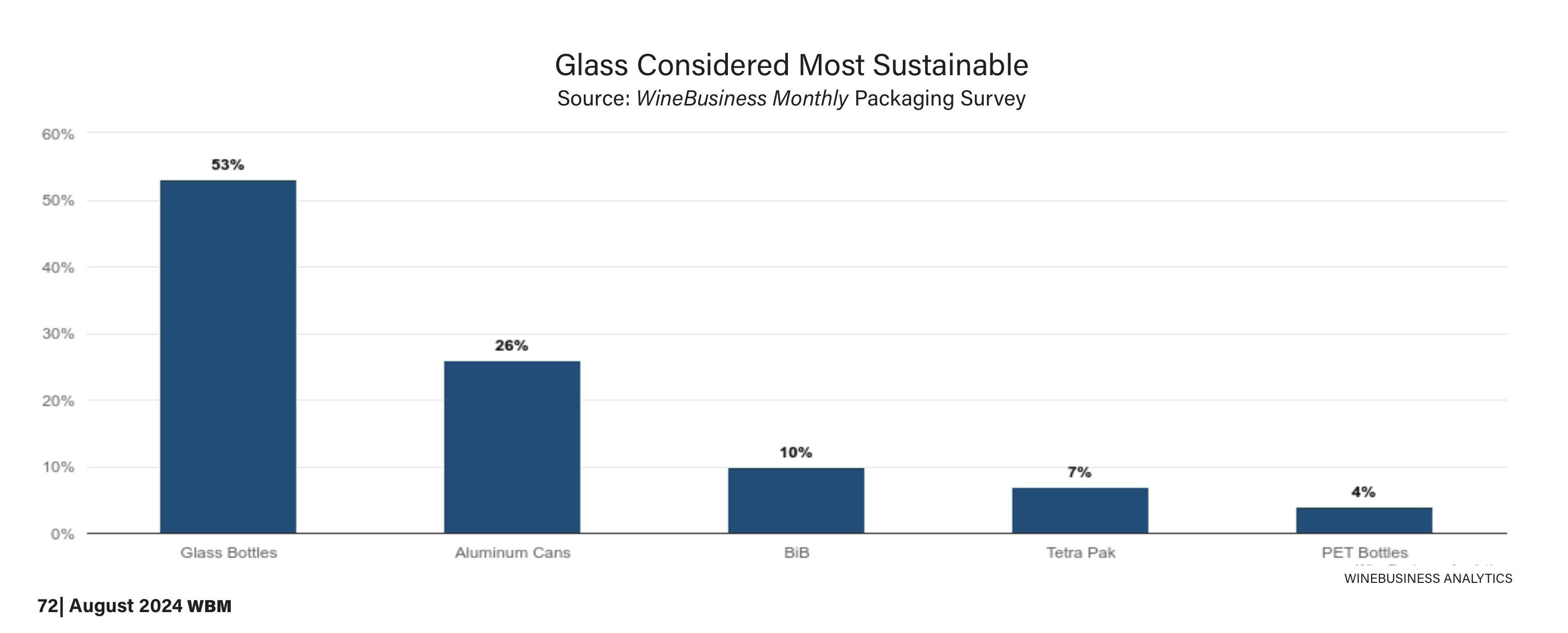

Among surveyed wineries, glass is considered the most sustainable option with 53% of surveyed wineries picking it over other common materials and formats. The share of those picking glass as the most sustainable option was the highest in the Central Coast with 75% of those surveyed.

By size, only the largest wineries producing more than 500,000 cases a year considered aluminum cans the more sustainable option with 40% and glass bottles and Tetra each accounting for 27%. Just shy of 46% of limited production wineries, making fewer than 1,000 cases a year, consider glass the most sustainable packaging option while 29% picked cans.

Wineries also continue to shift their glass buying to domestic suppliers, with 76% now reporting they source from the United States. The 2023 survey found 55% of surveyed wineries buy glass from domestic sources. The share of Chinese glass also declined from slightly more than 40% to 37%.

By region, 92% of the wineries in the Pacific Northwest are buying U.S. glass followed by Sonoma County at 87% and the rest of the U.S. at 75%. Domestic glass was the top pick among the largest wineries with 93% and accounted for more than 70% for all other sizes.

When buying glass, the majority (57%) of wineries surveyed use a broker but 73% of the largest wineries do source directly from the manufacturer. That makes sense as the leading reason why wineries use a glass broker (51%) is that their orders are too small to be fulfilled by the manufacturer.

Nearly three fourths (74%) of wineries surveyed have no plans to switch to a lightweight bottle and 70% did not reduce the weight of their most used bottle in the past year as well. More than 37% of all wineries surveyed reported they already have switched to a lighter weight bottle and that share was highest among wineries in the Pacific Northwest with 65%.

Among Napa County wineries, 24% report using a lighter bottle would look less premium or “hurt my brand” while 17% of Sonoma County wineries, 20% of Central Coast and 46% of wineries in the rest of California category selected the same answer. According to this year’s survey, the leading glass bottle weight is 16oz, which was the most-used bottle for 28% of wineries surveyed followed by 24% that use 20.3oz glass. In 2023, the leading glass weight was 20.3oz followed closely by 17oz.

A Classic Approach to Emphasize the Vineyard

Jean Arnold, who is the founder and owner of Kate Arnold Wines, said all the bottles he uses average less than 17oz in weight. He said that’s likely on the low end for comparably priced wines, and while he acknowledged lighter glass is better for the environment it’s also better for his bottom line.

While Arnold is a former executive with one of the largest wine companies in the United States, he launched his brand with his own money and so cost is never far from his mind. The brand launched with two wines – a Lake County Sauvignon Blanc and Willamette Valley Pinot Noir – and has production steadily increased, Arnold has expanded his sourcing to all three West Coast states. Kate Arnold’s lineup also now includes reds from Washington state.

Arnold is based in Georgia, but the wine is produced at a custom crush facility in Oregon. He said his plan for the brand has been to always source from exceptional vineyards and let the wines speak for themselves. “If you look at our packaging it’s all about our fruit sourcing,” he said. “Classic and conservative is the way to go if ultimately I’m focused on wine quality and fruit sourcing.”

A simple, streamlined and classic profile allows for subtle and quick packaging changes, yet it also conveys quality and premium winemaking, Arnold said. Considering the fires, freezes and other climatic disruptions in recent years, a simple label is also easy to update when grape sourcing needs to shift.

That doesn’t mean Arnold is opposed to innovation. For his Willamette Valley Pinots, he closes those under screwcap while the single-vineyard Pinots are sealed with a Diam cork. He said the company has also done quite well packaging an organic Sauvignon Blanc into recyclable Petainer kegs for on-premise accounts.

Total production is around 25,000 cases and Arnold said he sells in 30 states as well as to key export markets. That means Arnold has already added QR codes to his labels to comply with the new EU regulations requiring such information. He said he doesn’t mind adding the additional information as it also provides him a blueprint on how to do it if required by U.S. regulators.

Arnold also buys grapes from LIVE certified vineyards, and he said having that type of information on the label is also important to consumers as well as members of the trade in export markets. He said he views adding such information to his labels as part of the transparency needed after making a commitment to always putting quality first.

“Packaging should be a reflection of your grape sourcing,” he said. “We’re grape to bottle and more concerned about vineyards.”

A Packaging Journey

Erica Orr launched her own brand, Orr Wines, in 2013 after working at several other estates including Cain in Napa Valley and Domaine Dujac. Based in Washington, Orr also runs a winemaking lab offering analytical services to other wineries.

The annual production for her brand is around 700 cases and while production remains small her packaging strategy has evolved since she launched her brand.

“It’s been a journey,” she said. “At the beginning of my start-up company I felt I could not risk any TCA contamination.”

Not only was Orr focused on producing a lesser-known white, Chenin Blanc, she had launched her brand via distribution to retailers and restaurants. Given her market and varietal, she said she had absolutely zero tolerance for any cork taint.

For Orr, that meant sealing all her wines under Portocork’s most expensive option; the Icon, which is individually tested and guaranteed free of any impurities. She has since opted for Diam closures that she says have been reliably clean while significantly cheaper. In recent years, Orr also stopped using capsules. She said screwcaps would be an even more affordable option but it’s not the right fit for her brand or wines.

The majority-around 65%-of her sales remain via distribution and those placements and her prices demand a premium approach, which means corks, paper labels and glass. Because she orders in small quantities, Orr had to shop around to find a domestic supplier with the bottle molds she needed although she’s still looking for glass that’s a bit lighter.

“I feel like critics care about this now,” she said. “I don’t even know if I see a savings in shipping, but I feel the trend is to go lighter weight.”

In addition to her own branded wines, Orr also produces a wine to support Washington vineyard workers. Using 1.5 tons of Merlot donated from Stillwater Creek Vineyard, Orr produced the inaugural 2020 Royal Slope Red wine the proceeds of which paid for a visit by the Columbia Basin Health Association Othello Clinic to provide free health screenings and flu vaccinations for 35 vineyard workers in 2023. Orr said she may opt to use screwcaps on that wine to further reduce costs and pass along even more money for the cause.

Adding Info Sought by Consumers

Located in Suttons Bay, Mich., Mawby produces around 30,000 cases of wine a year and most of that is in glass as the winery specializes in sparkling wine. The winery produces a mix of charmat and methode champenoise sparklers with European equipment and then uses a European bottling line.Owner Peter Laing said it just makes everything easier to use European glass. He said the winery had been getting hammered by exorbitant shipping container surcharges that ranged from 20% to 30% and were imposed soon after the start of the COVID-19 pandemic. Those costs have since eased, and he was happy to say his packaging suppliers had been very transparent in itemizing out the surcharges and not just raising their prices.

He said the winery has found some success selling kegs to restaurants and even breweries. Laing said brewers want to offer a local wine option for their guests, which can be served on tap.

“Those get our name out there on a bunch of by-the-glass lists,” he said. Mawby uses one-way recyclable kegs from Lightweight Containers.

Bottling under pressure does limit the winery to heavier, sturdier glass but Laing said he’s very interested about the possibility of European glass makers unveiling lighter bottles that can offer the same tolerances needed for sparkling wine. “That’s one of the challenges, we’d love to reduce our carbon footprint,” he noted.

In addition to 750mls, Laing said the winery also regularly uses 1.5L glass as well as 375mls and 187ml bottles that have been popular with restaurants.

Laing said he fully supports more label information regarding ingredients and nutrition and said he called in to the TTB’s public comment line to state so publicly.

“If the consumers are asking for more info, we’re going to include it whether it’s required or not,” he said.

He added he would appreciate guidance on what may be required so the winery doesn’t have to update its labels more than once and he’s hoping U.S. officials will follow the EU’s example and allow for QR codes to link to a website providing all additional information. He said he also expects there to be standardized nutrition information or a readily available calculator so small wineries like Mawby and thousands of others across the United States don’t have to send a sample off to a food lab for each bottling run.

What’s required on U.S. wine labels may change in the future, but what winemakers consider in developing a packaging strategy remains consistent: cost, function and appropriateness for varietal and price.

METHODOLOGY

The 2024 WineBusiness Monthly Packaging Survey survey was conducted between March 11 and April 5, 2024.

The survey participants include winemakers and winery management involved in packaging decisions. Respondents include contacts at wineries of all sizes and states across the U.S. From a total universe of 10,000 U.S. wineries.

The responses were structured to enable reporting by winery size (annual production) and geographic location. Allowing us to accurately report information for the total market. Accepted statistical techniques are employed to allow segmentation as indicated in the data presented.